Coffee - A Global Perspective

)

This article is brought to you by our Knowledge Partner Daymon

The coffee category, the world’s most popular hot beverage, relies on a frail balance between challenging production and transportation as growing and evolving consuming demand. These factors impact the end consumer and shape trends or purchase decisions.

Ingredient Global Context

In 2024, coffee beans were the second most traded commodity after crude oil. However, they come from a slowly developing plant, mostly grown in remote, mountain areas and are quite sensitive to extreme weather episodes.

The two main types of coffee are Arabica and Robusta. Arabica has a 60% weight on total production and presents a smoother and slightly acidic flavour, while Robusta has a stronger bitterness, which leads to different usage types. Arabica is cultivated in higher altitude regions and is often used for more premium ranges. Conversely, Robusta can be grown in harsh environments and is generally allocated for lower-quality options (Mintec).

Coffee For The End Consumer

If Latin America and Asia Pacific are major producers and exporters, consumption sits elsewhere. In 2024, the USA, Brazil and Germany accounted for over 30% of the market share, while the highest consumption per capita was in Finland, Sweden and Denmark (Euromonitor, ICO, World Bank). This creates a sharp contrast between production and consumption areas, which results in significant transportation costs, heavily impacted by fuel price fluctuations or political instability. When it comes to consumption per capita, two very distinct realities emerge.

Western Europe and North America represent mature markets, with a flat evolution, while other players like MEA or Asia Pacific have much room to grow and consolidate their position. MEA’s market is forecasted to be the fastest-growing region in the next five years, with a predicted 10% value increase (Euromonitor).

In Saudi Arabia, where the ritual of having a coffee with family and friends is deeply embedded in local traditions, it is the third largest market in the MEA region, only behind Ethiopia and Algeria. Furthermore, the recent Vision 2030 program promoted tailored support for local farmers to enhance production and boost coffee quality. This included training, resources for optimised farming and improved access to markets for local products. In 2025, the bulk of coffee production comes from LATAM and Asia Pacific, from big exporters like Brazil (33%), Colombia (7%) and Vietnam (16%) (Mintec).

Key Category Trends

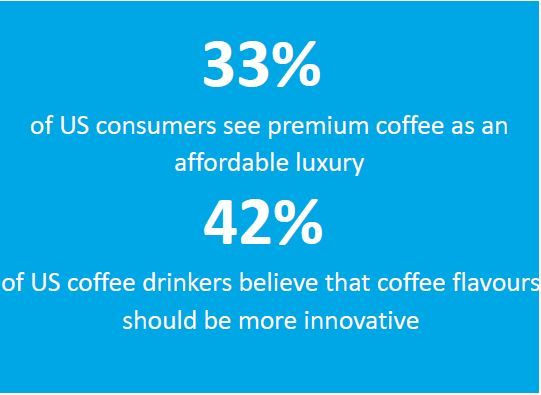

The coffee dynamics have been reflecting the current troubled economic scenario. Lower production from key exporters like Brazil has been fueling price hikes, as the offer decreases and demand remains high. However, as the end consumer is already pressured by persistent inflation and uncertainty, monthly budgets have more difficulty accommodating non-essential expenditures.

This doesn’t mean that such a deep-rooted habit will falter exclusively due to cost. Instead, it paves the path for affordable yet enjoyable solutions that can provide consumers the necessary comfort a cup of coffee can bring, without compromising either on quality or taste. Private Brand has been successfully exploring this opportunity, reaching the second place in the global market, between instant-driven Nescafé (with 12% of market share) and more premium Nespresso (6%) (Euromonitor).

The One World trend from Daymon’s Trendwheel plays a key role in coffee, mirroring the growing consumer demand for products (and brands) that comply with more sustainable practices. This demand now covers the entire value chain, from the production of the product itself to the farmers' welfare, from the supply chain to the commercialisation. Thus, key certifications like Fairtrade, B Corp or FSC help to convey these sustainable assets to consumers.

A recent launch in Germany, Alrighty’s TrueCrema Coffee Beans, comes from underdog farmers, essentially young, female or from Africa. Indulgence was not left aside and a minor change in flavour, texture, or scent can go a long way. Fueled by social media content, the JOYment trend is reflected on such products as Kroger’s Roast Maple Coffee Cake Pods in the US. In parallel, consumers still seek total solutions that can offer an optimal health and wellness balance. Thus, the B-Well trend is reflected in products like Dr Oetker’s Caramel Macchiato w/High Protein Drink, also launched in Germany.

Key Highlights

-

Due to its dependence on local and global contexts as well as climate conditions, coffee, as a raw ingredient, needs to be constantly monitored to anticipate variations as much as possible and react fast when needed.

-

The coffee category has room to grow in sales by exploring less mature regions in consumption per capita, such as Asia Pacific and Middle East and Africa.

-

In already mature markets in consumption per capita and consumer penetration, growth potential will be on solutions that cater to evolving consumer needs such as sustainability, experience and value.

Source: Daymon

About Daymon

With 50 years of experience building successful Private Brand programmes around the world, Daymon has developed a unique industry-leading approach to driving sales and profits for partners and clients. This links to our global industry knowledge with market insights and consumer trends to create actionable business solutions. Through our extensive industry expertise in Private Brand development and innovative retail services, we offer transformative solutions to help our partners